About Product

Life Insurance LegacyPro is a traditional life insurance product with periodic premium payments that provides death benefits until the insured is 100 years old, basic insurance premium waiver benefits, and booster benefits for the sum insured when the insured reaches 75 years old.

What are the benefits of Protection

Allianz LegacyPro?

Insurance Period up to the Insured Age 100 years.

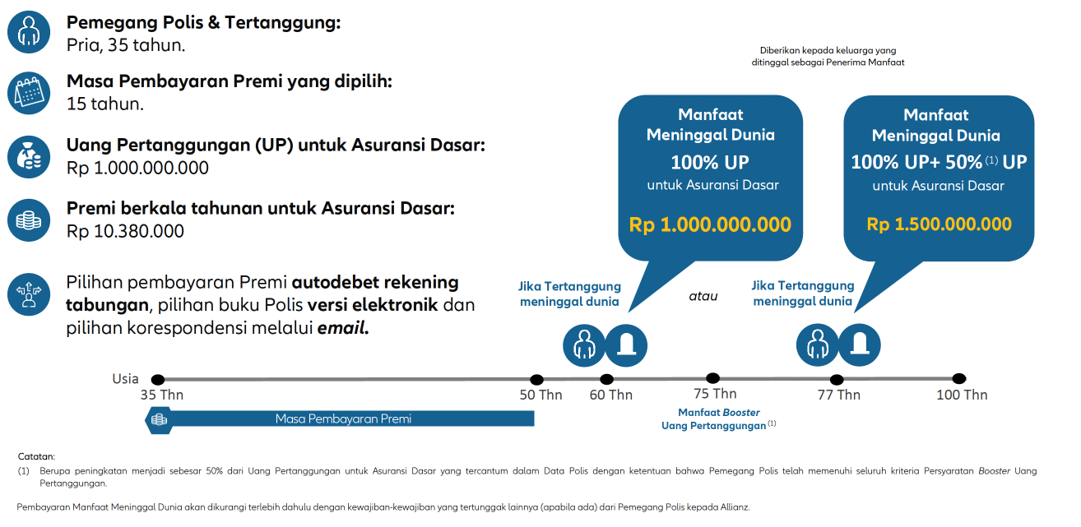

Choice of Premium Payment Period starting from 5,10 & 15 years.

100% of the Sum Assured for Basic Insurance if the Insured Dies

Benefits of the Sum Insured Booster are available up to 50% of the Sum Assured for Basic Insurance when the Insured reaches 75 years of age

Basic Insurance Premium Waiver Benefits are available if the Insured is diagnosed with one of 77 Critical Illnesses/Conditions

Protection Benefits For Various Risks

Basic Insurance Benefits

Death Benefit + Sum Assured Booster Benefit

- 100% Sum Assured for Basic Insurance if the Insured dies and the Policy will end.

- When the Insured reaches 75 years of age, We will provide a Benefit Booster Amount Assured in the form of an increase in the Sum Assured for Basic Insurance with the following conditions:

a. Becomes 50% of the Sum Assured(1) for Basic Insurance provided that the Policy Holder has met all the criteria for Requirements Booster The Sum Assured, or

b. Becomes 25% of the Sum Assured(1) for Basic Insurance in the event that the Policy Holder does not meet one of the Requirements Booster The Sum Assured(2) or no longer fulfills one of the Requirements Booster Amount Assured(3).

Note:

- The Sum Insured for Basic Insurance listed in the Policy Data.

- In the event that the Policy Holder does not fulfill one of the Requirements Booster Sum Assured, the Sum Assured for Basic Insurance will be increased by 25% of the Sum Assured for Basic Insurance stated in the Policy Data ("Seal Insured >Booster 25%”).

- In the event that the Policy Holder has met the Requirements Booster Cuminsured, and has received the Benefits Booster The Sum Assured is in the form of increasing the Sum Assured to Sum Assured Booster 50%, but after that it no longer fulfills one of the Requirements BoosterSum Assured, Sum Assured Booster 50% will be adjusted and changed to Sum Assured Booster 25 %.

Payment of Death Benefit will be deducted in advance by other outstanding obligations (if any) from the Policyholder to Allianz.

The requirements for the Sum Insured Booster refer to the provisions stated in the applicable policy.

Benefits of Basic Insurance Premium Waiver

Exemption from payment of Basic Insurance Premium, starting from the next Premium Payment Due Date (after the date of claim approval by Allianz) until the end of the Premium Payment Period.

If the Insured suffers from one of the 77 Critical Diseases/Conditions as referred to in the Special Terms of the Policy, and the claim for Basic Insurance Premium Waiver Benefits has been approved by Allianz.

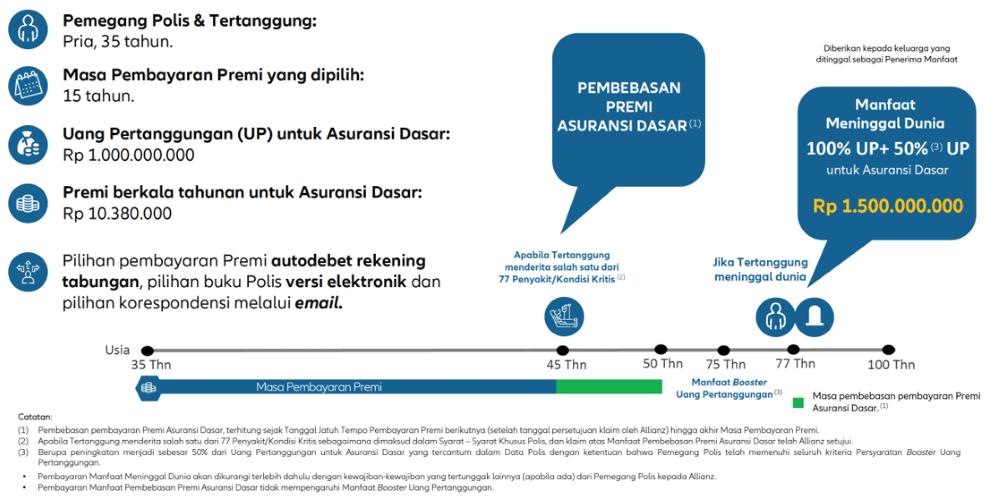

Example Illustration Benefits

Illustration of Basic Insurance Premium Waiver Benefits

Illustration of Death Benefit + Sum Insured Benefit Booster

Product requirements

Exception

In accordance with the terms & conditions that apply in the Policy

Underwriting

Full Underwriting

Download Brochure

More detailed information for the Allianz LegacyPro Insurance brochure

General Product and Service Information Summary (RIPLAY)

More detailed information for RIPLAY Allianz LegacyPro Insurance

Need more information?

To consult regarding Life Insurance LegacyPro, please contact by clicking the WhatsApp button below:

Or for an illustration request, please Click Here to fill out the illustration application form by complete.

then we will contact you within 1×24 hours.